Are Any Covid Expenses Tax Deductible . | tax & legal | 29 july 2020. expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. T you and your loved ones are staying safe and healthy despite these challenging times.

from www.bbc.com

T you and your loved ones are staying safe and healthy despite these challenging times. singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. | tax & legal | 29 july 2020.

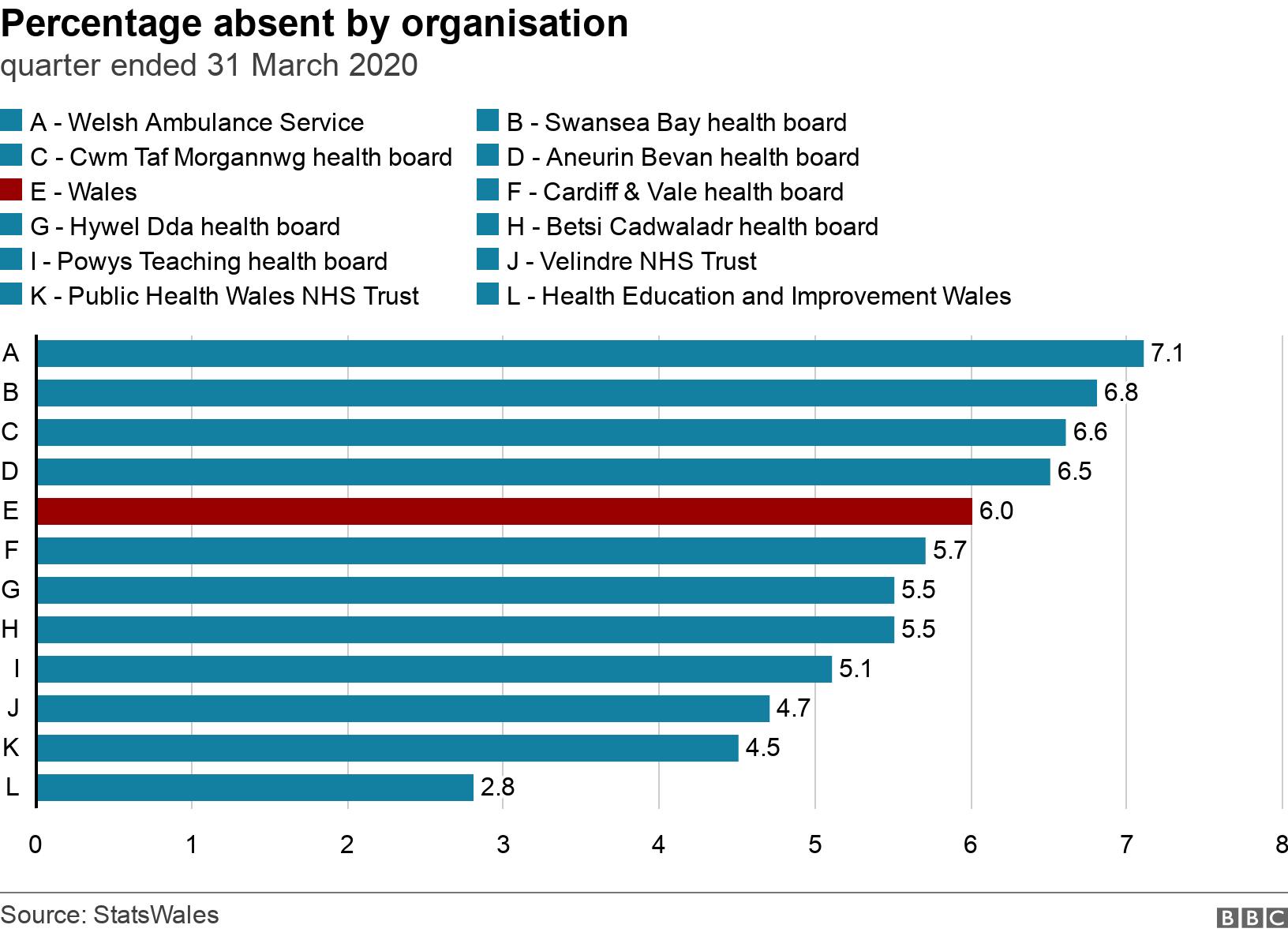

Coronavirus NHS sickness highest on record at pandemic's start

Are Any Covid Expenses Tax Deductible expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. | tax & legal | 29 july 2020. singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. T you and your loved ones are staying safe and healthy despite these challenging times. expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions.

From www.oversixty.com.au

Covid tests to be tax deductible with a catch OverSixty Are Any Covid Expenses Tax Deductible T you and your loved ones are staying safe and healthy despite these challenging times. expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. | tax & legal | 29 july 2020. singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. Are Any Covid Expenses Tax Deductible.

From medicalxpress.com

COVID19 coronavirus could cost the US billions in medical expenses Are Any Covid Expenses Tax Deductible expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. T you and your loved ones are staying safe and healthy despite these challenging times. | tax & legal | 29 july 2020. singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. Are Any Covid Expenses Tax Deductible.

From eforms.com

Free Medical Hardship Letter Sample PDF Word eForms Are Any Covid Expenses Tax Deductible expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. T you and your loved ones are staying safe and healthy despite these challenging times. | tax & legal | 29 july 2020. singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. Are Any Covid Expenses Tax Deductible.

From www.damore-law.com

Tax Deductible Home Ownership Expenses Are Any Covid Expenses Tax Deductible T you and your loved ones are staying safe and healthy despite these challenging times. expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. | tax & legal | 29 july 2020. Are Any Covid Expenses Tax Deductible.

From markham-norton.com

COVID tax relief / Fort Myers, Naples / MNMW Are Any Covid Expenses Tax Deductible | tax & legal | 29 july 2020. expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. T you and your loved ones are staying safe and healthy despite these challenging times. Are Any Covid Expenses Tax Deductible.

From www.shopify.com

Understanding Nondeductible Expenses for Business Owners Are Any Covid Expenses Tax Deductible expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. T you and your loved ones are staying safe and healthy despite these challenging times. | tax & legal | 29 july 2020. singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. Are Any Covid Expenses Tax Deductible.

From wedcbiz.org

COVID19 Capital Costs Tax Credit Program Webinar WEDC Are Any Covid Expenses Tax Deductible singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. T you and your loved ones are staying safe and healthy despite these challenging times. expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. | tax & legal | 29 july 2020. Are Any Covid Expenses Tax Deductible.

From www.forbes.com

Tax 101 Expenses Reimbursed With COVID19 Aid Should Not Be Deductible Are Any Covid Expenses Tax Deductible expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. | tax & legal | 29 july 2020. singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. T you and your loved ones are staying safe and healthy despite these challenging times. Are Any Covid Expenses Tax Deductible.

From www.commercialcreditgroup.com

Tax Deductible Business Expenses Under Federal Tax Reform CCG Are Any Covid Expenses Tax Deductible T you and your loved ones are staying safe and healthy despite these challenging times. singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. | tax & legal | 29 july 2020. Are Any Covid Expenses Tax Deductible.

From parallaxaccounting.com.au

Tax Deductibility of COVID19 Test Expenses Are Any Covid Expenses Tax Deductible expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. | tax & legal | 29 july 2020. T you and your loved ones are staying safe and healthy despite these challenging times. Are Any Covid Expenses Tax Deductible.

From www.kff.org

Among Covered Workers With a General Annual Deductible for Single Are Any Covid Expenses Tax Deductible singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. | tax & legal | 29 july 2020. T you and your loved ones are staying safe and healthy despite these challenging times. expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. Are Any Covid Expenses Tax Deductible.

From www.schwab.com

Investment Expenses What's Tax Deductible? Charles Schwab Are Any Covid Expenses Tax Deductible singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. | tax & legal | 29 july 2020. expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. T you and your loved ones are staying safe and healthy despite these challenging times. Are Any Covid Expenses Tax Deductible.

From www.forbes.com

IRS Confirms HighDeductible Health Plans (HDHPs) Can Cover Coronavirus Are Any Covid Expenses Tax Deductible singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. | tax & legal | 29 july 2020. expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. T you and your loved ones are staying safe and healthy despite these challenging times. Are Any Covid Expenses Tax Deductible.

From markham-norton.com

Deadline to file covid penalty relief postponed / Ft Myers, Naples / MNMW Are Any Covid Expenses Tax Deductible expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. T you and your loved ones are staying safe and healthy despite these challenging times. | tax & legal | 29 july 2020. singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. Are Any Covid Expenses Tax Deductible.

From www.wsj.com

Amazon's Covid19 Costs Rise as Staffing Grows Are Any Covid Expenses Tax Deductible expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. T you and your loved ones are staying safe and healthy despite these challenging times. | tax & legal | 29 july 2020. singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. Are Any Covid Expenses Tax Deductible.

From www.kff.org

Among Covered Workers With a General Annual Deductible, Percentage With Are Any Covid Expenses Tax Deductible singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. | tax & legal | 29 july 2020. T you and your loved ones are staying safe and healthy despite these challenging times. expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. Are Any Covid Expenses Tax Deductible.

From www.hindustantimes.com

ITR filing All you need to know about claiming deductions for Covid19 Are Any Covid Expenses Tax Deductible singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. | tax & legal | 29 july 2020. expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. T you and your loved ones are staying safe and healthy despite these challenging times. Are Any Covid Expenses Tax Deductible.

From www.heelanassociates.co.uk

Videos Heelan Associates Are Any Covid Expenses Tax Deductible singaporeans and singapore permanent residents (sprs) who are exercising overseas employment and working. expenses incurred wholly and exclusively in the production of employment income are tax deductible if the following conditions. T you and your loved ones are staying safe and healthy despite these challenging times. | tax & legal | 29 july 2020. Are Any Covid Expenses Tax Deductible.